We recently finished a major pricing exercise with a start-up in the enterprise software space: tuning up their prices, improving their upgrade model, and looking at alternative pricing metrics (i.e. what to meter when quantifying the customer’s usage). A great opportunity to match quantitative models against actual customer behaviors.

During the engagement, the client’s sales team identified some real-world messiness that we (as product managers) would prefer to ignore: high-end customers who demand enterprise-wide licenses – instead of limited-use licenses tied to volume. These are sometimes called “all you can eat” or AYCE deals. Let’s describe the situation, then explore a few of the messy conclusions.

Pricing for Volume

We always try to price our products based on customer value, but enterprise software is ultimately tied to some unit of measure: the thing we count to see how much customers owe us. (See Disruptive Pricing Units and Pricing for Start-Ups). Oracle favors per-CPU pricing; SalesForce focuses on per-seat-per-month subscriptions; Symantec counts desktops; VeriSign and RSA track tokens or certificates.

To protect the innocent, let’s imagine a fictional product that scans each customer’s software and magically identifies obscure coding mistakes. Our uniquely fictional pricing model is to charge only for the mistakes our product finds. Scanning clean code is free, but users will pay us for each error that this is detected and explained.

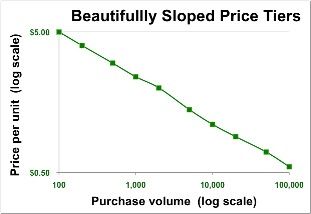

Being deeply analytical product managers, we’ve carefully built a tiered pricing structure which gives deeper volume discounts as customers buy more. For $500 per month, the customer can identify up to 100 mistakes. (That’s $5 per error). $800 per month to find up to 200 problems (at $4 each), $1500 for 500 mistakes ($3 each) and so on. It turns out that a perfectly designed pricing model will appear linear on a log/log chart, so we build some very impressive scatter charts. We feel great, having brought order to a complex problem.

Yes, But…

All is going well until the deals start to get big, and enterprise customers assign their purchasing agents to negotiate contracts. Suddenly, customers start to toss the following at our sales teams:

- “We write a tremendous amount of software, and have no idea how count the errors that come out of Development. Just give us a one-time ‘all-you-can-eat’ price for unlimited use, and we’ll consider it.”

- “If we make you part of our standard software process, we’ll be scanning billions of lines of code each month. That could turn up tens of thousands of very minor errors. You’ve priced yourself out of being a strategic solution that we use everywhere. We shouldn’t bother with a proof-of-concept test if we know we can’t afford to choose you.”

- “We preconfigure all of our servers the same, with copies of every software package we might need. That way, everyone in the Engineering and Operations groups has identical tools. All of our other vendors have agreed to site-licenses and unlimited installations.”

Sales people hear this all the time. Product managers, though, are buffered behind layers of Sales Ops and SEs and Marketers. As product managers, though, we’re surprised that our carefully designed pricing plans don’t fit every situation. And we want to take these demands at face value – assuming the customers are communicating clear pricing requirements. Customer input is our credo. (“Gee,” says the PM. “I guess we need a site license for deals above 20,000 errors detected per month.”)

So, to get some perspective, Enthiosys polled some Sales VPs at other enterprise software start-ups. How do they think about customer demands for site licenses and ‘all-you-can-eat’? What’s real and how can you tell? Here’s what I learned:

Selling is a Messy, Inexact Process

[1] Customers try to get the best deal from us. Some have well-designed buying processes to force down prices. This includes purchasing agents paid based on the discount they negotiate; buying from multiple vendors; demands for unreasonable service level agreements; product bake-offs; painstaking reviews of license agreements; upgrade guarantees; pay for performance; etc. Some prospects demand ‘most favored nation’ pricing, where they are entitled to the lowest price you offer to any customer, ever.

So the enterprise buying process often includes a demand for site licensing, regardless of whether it’s truly required by the customer.

Good sales reps can usually sort out whether the customer has a legitimate need for AYCE or is simply using it as a negotiating tactic. (Often, there’s a champion on the customer side who clues in our sales team.) And good Sales VPs push hard to minimize special deals.

[2] Taking the deal off the table. If you have competitors (and everyone has competitors), the market sets an upper limit for some deals. Large customers can get your competitors to chop prices, and you’ll be forced to follow. Sales teams are paid to discover how much money the customer will actually spend, and which are mostly motivated by saving money. Eventually, your Sales VP has to decide which deals are important enough to throw away the price list and agree to something unique.

[3] Some customers have a legitimate need for enterprise-wide licensing. There may not be a reasonable way to track usage, or it may be extremely hard to predict volumes before deployment. Or perhaps your customer is bundling your cool-new-thing into a package that incorporates many different pieces, and is pricing that on an entirely different basis. Etc.

It’s your job as a product manager, though, to generalize these deals. What if fifty more customers presented the same reasons for AYCE? Have we created a convenient way to undercut our pricing strategy and revenue stream?

So What Should We Do?

Our panel of Sales VPs offered two thoughts for managing individual deals and limiting the impact of AYCE licenses.

- Is this one of our top 10 deals for the quarter? If not, then we shouldn’t spend our energy chasing a one-off with unique terms and conditions. The sales team needs to refocus on selling the value of our solution, or identifying champions within the account to push our agenda. And we might just lose this one.

- How can we put limits on this initial sale, and come back later for additional revenue? Maybe we offer an ‘all-you-can-eat’ for three years, and postpone renewal terms for a while. Maybe we set a very large volume cap (up to 50,000 errors per month) and revisit usage after the first year. Maybe this license only covers one division of a huge company, and we’re free to sell more elsewhere. We should avoid unlimited perpetual licenses whenever we can.

Back on the product management side, it’s important to watch for trends without letting a handful of deals whipsaw our pricing model. Part of PM’s value is to provide strategy and stability in the face of daily events.

Sound Byte

High-end selling is a messy, complicated, people-intensive process. Every deal appears to be a special case. Sales teams are hired, trained and paid to sort it out and find the revenue. Product managers should be humble, helpful and ready to spot the trends.